Insurance Inspections

Drones are becoming a popular tool for insurance inspections.

Incredible Group help loss adjusters to get a closer look at damage claims. Using drones vastly reduce’s the risk and time involved in inspections compared to physical inspections.

Benefits Drones Offer To Insurance Inspections

There are many reasons drones are catching on for insurance inspections. Some of the benefits drones offer include:

Speed: Drones allow insurance inspectors to cover a lot more ground. This can save time and money during the inspection process.

Accuracy: Drones give insurance inspectors a closer look at damage claims. This can help them to make more accurate assessments.

Efficiency: Drones can inspect areas much faster than a person on the ground. This saves companies time and labour costs.

Data: Drones are able to capture more data than other methods of inspection. This data can help insurance inspections make better decisions about claims

Costs: Drones decrease the number of field adjusters needed on site. Insurance companies can save on the cost of having a field adjuster go to the scene of the accident.

Roof Insurance Inspections

There are many ways to conduct roof insurance inspections. Including scaffolding and rope access. But drones provide the safest, most accurate and fastest results. Roof inspections are essential for assessing insurance claims. Drones make this process much easier and more accurate.

Without drones, insurance companies would need to send out people to inspect roofs. This is a time-consuming and expensive process.

Drones provide accurate data for roof inspections by flying in tight spaces. Manoeuvre around objects that would be difficult or impossible for a person to reach. This allows drones to collect more accurate data, essential for insurance inspections.

Drones can create 3d models of roofs. Insurance agents can reference the 3D model to compare the damage. Matching the interactive 3d model with pictures taken before the event.

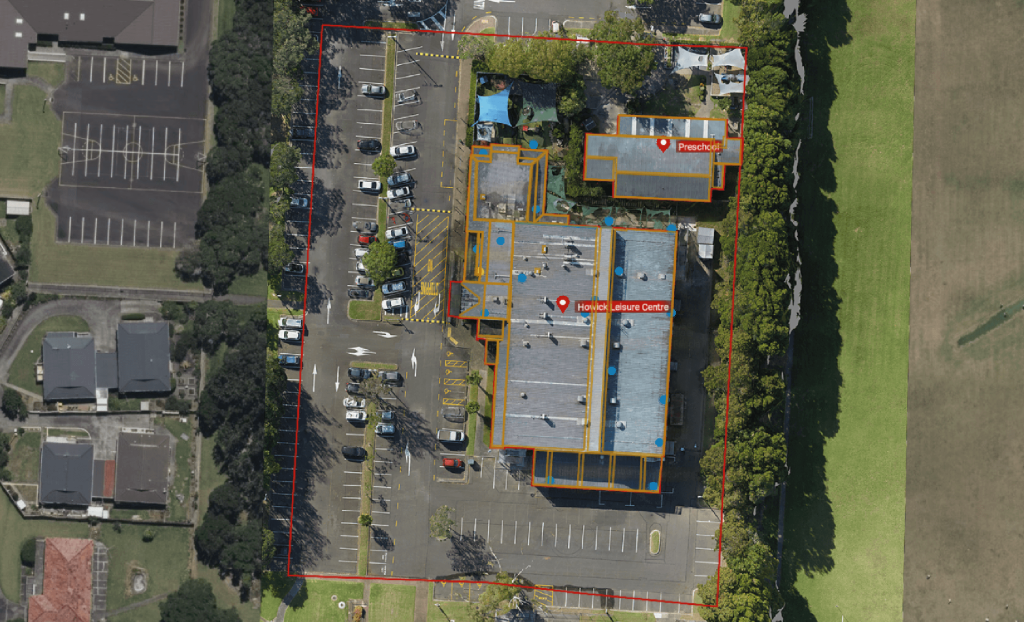

Property Insurance Inspections

There are several problems with traditional property inspections. One issue is that they are often inaccurate. They can also be expensive and time-consuming. Drones can help to overcome these issues. By using drones for insurance inspections, you can get a more accurate view of the property. Providing the ability to complete the inspection quickly and efficiently from your desktop, which also allows you to revisit areas without having to access the site or asset again.

Drone technology has come a long way in recent years. Drones are now able to capture 4k high-resolution images and videos of the property. This makes them an ideal tool for insurance inspections.

In addition to providing a more accurate view of the property. drones can also help to reduce costs and time delays. Insurance companies that use drones for insurance inspections have seen significant savings.

Drones are a more efficient and accurate way to conduct property insurance inspections.

Land Insurance Inspections

There can be many problems with on foot land surveys when it comes to insurance inspections. For one, they can be time-consuming and labour-intensive. This means that they can be expensive, and may not be workable for larger properties.

On foot, surveys can also be difficult to conduct in rugged or inaccessible areas. They may not provide a complete picture of the property.

Drones are changing this by providing a more complete view of the property. Able to navigate difficult or inaccessible areas. They speed up the process, making it more efficient and less expensive.

Drones conduct land surveys by flying over the area. Capturing thousands of pictures or video footage. This allows insurance companies to get an idea of the damage and how much it will cost to repair.

The drones can capture footage of the entire property, which can then create a map of the area. Creating interactive 3D areas of the property. Allowing insurance companies to get a better understanding of the damage.

These surveys help insurance companies to determine where they need to send people. Insurance companies that are not using drones for this are missing out.

Natural Disaster Inspections

There are many natural disasters that cause insurance claims. Some of the most common ones include Tornadoes, Flooding, Earthquakes and Wildfires.

Drones can assess the damage caused by natural disasters to a wide variety of structures. This includes homes, businesses, government buildings, and more. With insurance inspections, agents can get a better understanding of the damage caused. Assist in deciding how much it will cost to repair.

Inspection of Buildings

Drones can inspect the roof for damage and the walls for cracks. Drones can also inspect the inside of buildings for damage.

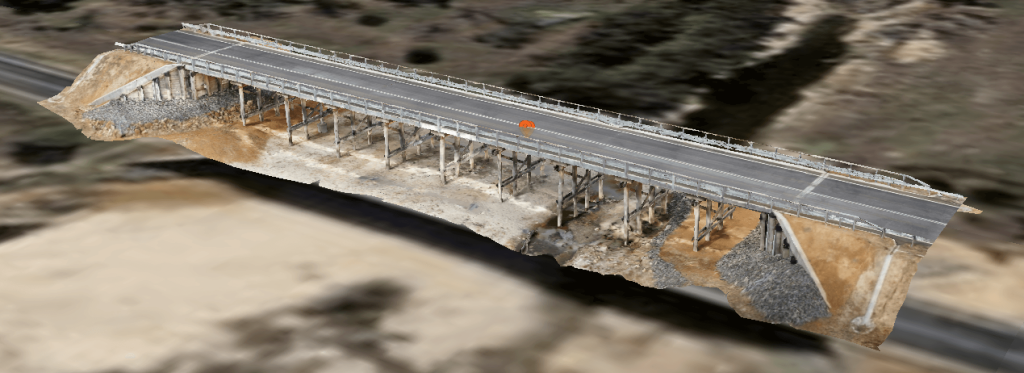

Inspection of Bridges

Drones can inspect bridges for damage. They can assess the condition of the bridge deck, and the condition of the bridge supports. Drones can also check for scour at bridge abutments.

Inspection of Roads

Drones are able to measure the width of a road and check for cracks in the asphalt. Drones can also inspect the condition of the guardrail, and the condition of the median.

Our dedicated team of qualified UAV pilots are here to help. Please get in touch so we can help with any questions.

- CAA 102 UAV Operator Certificate

- Experienced Pilots

- 10M Public Liability Insurance

- 60 Years combined experience

- 7000+ flights logged